Source from Economists

It is hard to imagine China could ever run shortage of this fuel. But in recent months, the black have been not quite immense enough. A scarcity of coal, which accounts for almost two-thirds of China’s electricity generation, has contributed to the worst power cuts in a decade. And the blackouts have, in turn, hurt growth. “Our economy is developing very fast,” Mr Burtynsky’s host tells him, so as to excuse the gloom and dirt in the air. But that is not quite true any more either.

Comment : The inflation derived from upstream of industry, it indeed inevitably make the inflationed factor transferred from supply side to buy side ( downstream) level by level, which the price is reflectively conveyed to end-user and ultimately push CPI index at higher level

But There is one question, How long does the entirely process of price-transfering to take ?? I mean the price-up launched with Commodity at Sep 2020, in the mid it goes through manufacturing, Utility, Technology, Real state, finally reach downstream of consumer - spending sector, how long it would take ! !

When inflation surge to the degree that out of control, on What date Fed lift up rate in emergency ?? At what date it will truly happened ? How long it takes ?

6 months ~ 1 year ~ 2 year or 5 years after China communists party have fallen down and being taken over by someone...

If the Super Inflation will come tomorrow, it will make you nervous without any further thinking, But if it will slowly move forward and take several seasons evenly accumulated for many years so that finally reveal on the stage, what do you think of the stock market now is correctly reflect our expectation on fundamentals or overly scary in psychological sense ! make a bet ~ Alex ! make a bet !

When supply is tight, prices are supposed to rise, obliging customers to economise on their consumption. But as the price of coal shot up, power stations were unable to pass their higher costs on. The amount they could charge the grid company that buys the bulk of their power could rise only up to 10% above a regulated price, which was changed infrequently. And the tariff paid by end-users was based on a catalogue of prices that was similarly inflexible. Some power stations simply stopped operating, refusing to generate at a loss.

Despite dramatic jumps in renewable energy output, the global economy remains hooked on coal for electricity. In Asia, coal's share of the generation mix is twice the global average - especially in surging economies such as India. In 2020, more than 35% of the world's power came from coal, according to the BP Statistical Review of World Energy. Roughly 25% came from natural gas, 16% from hydro dams, 10% from nuclear and 12% from renewables like solar and wind.

Consider the energy crunch first. The causes of the coal shortage fall into two categories: structural and incidental. The unlucky contingencies include floods in Henan province in July and in Shanxi this month, which forced some mines to close. In addition, in Inner Mongolia, which accounts for about a quarter of China’s coal output, an investigation into corruption has implicated and hamstrung some of the officials who might previously have approved expansions in coal mining. Shaanxi province, China’s third-largest producer of coal, slowed production to keep the skies clear for a national athletics event in September, which President Xi Jinping attended. And coal expansion has also been inhibited by safety inspectors, who have scrutinised 976 mines, after more than 100 industrial accidents nationwide last year.

The deeper reason for the coal crunch is China’s efforts to reduce its dependence on the fuel, which is responsible for a big share of the country’s carbon emissions. The authorities have been reluctant to approve new mines or the expansion of existing ones in recent years, because “it’s clearly driving the bus in the wrong direction”, says David Fishman of The Lantau Group, an energy consultancy.

I suggest to leave money in China market, which here are the several reason to why :

1.The China households income climbed up steadily in past 10 years, which place a solid ground for fostering consumer discretionary industry and I believe it has further potential to keep going ( Later we'll see the saving rate to household income)

- If inflationary issues officially debute in market, recent the power restriction just make huge concerns over left-up production cost of majority of factory, it's not necessarily the bad news for China macroeconomy. Based on finance theory, moderate inflation can ease the pressure from China local government debts, to extend the timing of debt default, It not seems like an illusion show, but also a trick that many countries' authority like to play in front of domestic audiences.

Let's take an example, today now the Consumer price index base is 100, Shanghai Municipal People's Government have 10 millon RMB debt due to 31 Dec 2021, and if we wait till end of 2021 year, Consumer price index base is 110, increase 10%, The Shanghai government collect more 10% tax revenue, and principal amounts of local debt still 10 millon RMB, not any changes, with increasing 10% tax revenue, it's more likely to cover the due paid of 10 million local debts

3. With more China young generation enter the workplace, the saving rate possibly to be lowered down below 40% from 44%

Before we talk about it, Let's review a classical economics equation :

a Country GDP = Consumption + Invesment + Government spending + exports - imports

Consumption we have stated at point.1 earlier in the text

1 .)For items of Investment, means personal durable good/ enterprise CAPX investment, to extract it further in details, Business school lecture books usually written in this way investment = Savings

In such case, Savings refer to the salary less living expense , insurance paid, car and house mortgage paid, the rest money to be deposited in personal bank account. and the deposited money used as fund for personal credit loan applied or for financial demand of enterprise's capital investment

2.) Now America value are still prevailing in every corner of the world, its way of life that pursuing individual achievements, with the successful job promotion, bring equivalents standard of physical living for themselves. Now such life value had been more and more spread and rooted into youngs of China, they would work hard and manage self-job career to demonstrate personal character. They don't really appreciate the past way of parents trait - working hard and save money as possible and devoting whole life to their children. Instead They will treat themself much more better, enjoy a gourmet with friends in well-designed restaurant monthly, buying some clothing and decorates in Boutique when off- work, doing traveling quarterly if affordable, These all are the furnishing soils for future China consumer industry to foster. If you little doubt that, why not take an observation on Nike. Inc this company their China business because the Fitness trend is all around developed countries, soon will be imitated and repeat in China as well

Let's see whether Nike's China sales grow 10-15% annualy in next decades, it's the best proof for consumption-orientated business constantly being stirred in China society, isn't it !

Back to the point of the Economic equation Invetment = Savings, Based on the social changes of China, youngs tend to choose a living with much more likely America's. I predict the Saving rate would keep falling down and the money would gradually transfer to items of Consumption year by year

My investment idea have been resonated with an article written by Martin Wolf, this guy of Economics sphere is a big one, please read as following

The economic threats from China’s real estate bubble by Martin Wolf

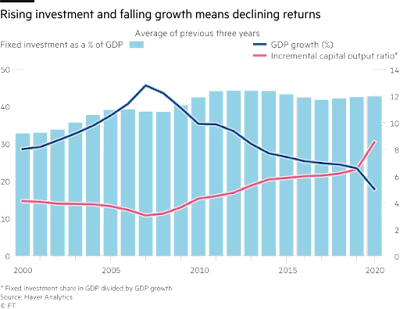

From the macroeconomic point of view, the most important fact about the Chinese economy is its extraordinary savings. In 2010, gross national savings reached 50 per cent of gross domestic product. Since then, it has fallen a little. But it was still 44 per cent of GDP in 2019. While household savings are extremely high, averaging 38 per cent of disposable incomes between 2010 and 2019, they account for slightly less than half of all these savings. The rest consist mainly of corporate retained earnings. Investment plus net exports have to match savings when the economy is operating close to potential output, if it is not to fall into a slump. Since the global financial crisis, net exports have been a small share of GDP: the world would not accept any more. Total fixed investment duly averaged about 43 per cent of GDP from 2010 to 2019. Surprisingly, this was 5 percentage points higher than between 2000 and 2010. Meanwhile, growth fell significantly. This combination of higher investment with lower growth indicates a big fall in the returns on investment (shown directly in a rising “incremental capital output ratio”). (See charts.)

Yet there are even bigger problems than this suggests. One is that the high investment is associated with huge increases in debt, especially of households and the non-financial corporate sector: the former jumped from 26 to 61 % of GDP between the first quarters of 2010 and 2021 and the latter from 118 to 159 %. Another is that a substantial part of this investment has been wasted. Xi Jinping himself has spoken of the need to shift “to pursuing genuine rather than inflated GDP growth”. This has to be a big part of what he meant. This combination of high and unproductive investment with soaring debt is closely related to the size and rapid growth of the property sector. A 2020 paper by Kenneth Rogoff and Yuanchen Yang argues that China’s property sector contributed 29 % of GDP in 2016. Among high-income economies, only pre-2009 Spain matched this level. Moreover, almost 80 percent of this impact came from investment, while about a third of China’s exceptionally high investment has been in property.

Between 2012 and 2019, investment contributed 40% of China’s growth in demand. If investment in property fell sharply, it would leave a huge shortfall. Yet tolerating this painful adjustment would ultimately be desirable. It should improve the welfare of the population: after all, building unneeded properties is a waste of resources. Slowing the recent pace of property investment would also be a natural consequence of the “three red lines” for property developers imposed by the state last year: hard limits on a company’s debt-to-asset ratio, its debt-to-equity ratio and its cash-to-short-term-debt ratio. The main policy now should be to shift spending towards consumption, and away from the most wasteful investment. This would require redistribution of income towards households, especially poorer households, as well as a rise in public consumption. Such a shift would also fit with the recent attack on the privileges of great wealth. It would also require big reforms, notably in taxation and the structure of public spending. In addition, investors should be shifted away from property toward the transition away from high carbon emissions. That too would require big policy changes.

Crises are also opportunities. The Chinese government is well aware that the great investment boom in property has gone far beyond reasonable limits. The economy needs different drivers of demand. Since the country is still relatively poor, a prolonged economic slowdown, such as Japan’s, is unnecessary, especially when one considers the room for improved quality of growth. But the model based on wasteful investment has reached its end. It must be replaced.